In the wave of digital transformation, enterprises are increasingly facing the challenge of information silos. Information silos refer to the inability of different departments or systems within an enterprise to effectively share and integrate information and data, resulting in collaboration difficulties and inefficiencies. This phenomenon not only hinders the smooth operation of business processes but also affects the decision-making ability of enterprise management. The problem of information silos is particularly prominent in the field of asset management.

Leveraging Asset Management Systems to Break Information Silos is critical for enterprises looking to optimize their operations and improve collaboration. Fixed asset management involves the entire lifecycle, including procurement, acceptance, and depreciation calculation, spanning two core systems: the asset management system and the financial system. If these two systems cannot communicate data effectively, it can lead to inconsistencies between accounting and actual information, inaccurate depreciation calculations, and auditing difficulties. This article explores how enterprises can leverage asset management systems to break information silos, achieving synchronized and efficient asset data management.

How Do Information Silos Impact Asset Management?

The issue of information silos is particularly evident in asset management. Fixed asset management in enterprises typically relies on both asset systems and financial systems. Asset systems manage physical information, such as procurement requests, acceptance, warranty management, and disposal, while financial systems focus on financial data, such as asset original value, accumulated depreciation, and net value. Due to differences in the technical architecture of these two systems, data cannot be synchronized in real-time, leading to the following major issues:

(1)Inconsistencies Between Accounting and Actual Information

When updates are made to physical information in the asset management system, the financial system may not synchronize in time, causing discrepancies in asset data between the two systems. For instance, an asset might be marked as disposed of in the asset management system, but the financial system still retains its depreciation records, directly affecting the consistency of accounting and actual data. Addressing this requires leveraging asset management systems to break information silos, ensuring real-time synchronization.

(2)Errors in Depreciation Calculation

The financial system may fail to acquire the latest asset changes from the asset system, leading to errors in depreciation calculations. For example, if the useful life or depreciation rules of an asset are updated in the asset system but not synchronized with the financial system, the finance department may calculate depreciation based on outdated data, impacting the accuracy of financial reports.

(3)Limited Data Query Capabilities

Managers can only query physical information in the asset management system and financial information in the financial system. The lack of a unified data view prevents managers from fully understanding the overall status of assets, affecting decision-making. A unified platform created by leveraging asset management systems to break information silos can solve this problem.

(4)Challenges in Audit Processes

Operations such as asset transfers or disposals require cross-system queries for historical data. This cumbersome process is not only time-consuming but also prone to errors, making audits more challenging.

How to Leveraging Asset Management Systems to Break Information Silos?

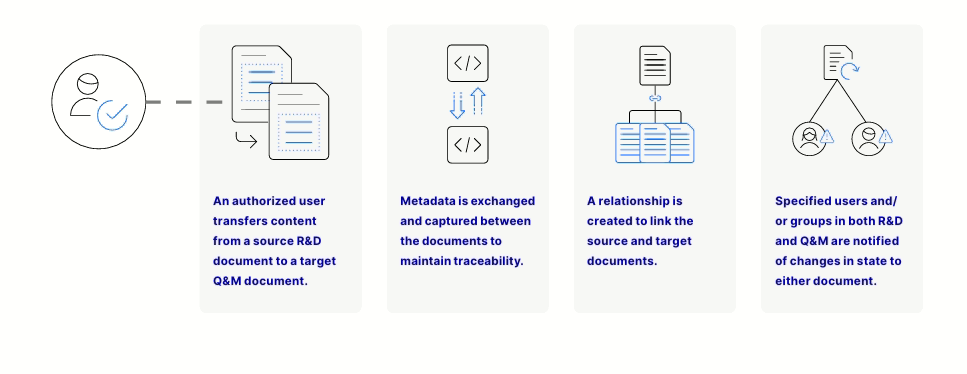

To address this issue, enterprises need to implement professional asset management systems and achieve deep integration with financial systems. According to the research in the OpenText White Paper: Breaking Down Information Silos, the formation of information silos is primarily caused by data isolation and lack of collaboration between multiple systems. Asset management systems, through unified data standards, real-time synchronization, and intelligent management functions, can effectively break down information silos and improve asset management efficiency. The following are specific solutions:

(1)Achieving Consistency Between Accounting and Actual Information

Asset management systems can use open APIs and data push functions to enable full integration between asset management systems and financial systems. By standardizing data, key attributes of the same asset (e.g., asset name, ID, usage status) remain consistent across both systems. For instance, when an asset is disposed of in the asset management system, the financial system automatically updates the related depreciation records, avoiding manual errors. This is a direct benefit of leveraging asset management systems to break information silos.

(2)Automated Depreciation Calculation

Asset management systems can automatically calculate asset depreciation based on the depreciation rules in the financial system and synchronize the results back to the financial system. This eliminates the need for manual data entry by the finance department, improving efficiency and ensuring data accuracy. For example, the system can calculate depreciation using the asset’s useful life and customized depreciation methods (e.g., straight-line or accelerated depreciation) and generate detailed depreciation reports.

(3)Comprehensive Data Query

Asset management systems integrate data, allowing users to query all asset information on a single platform, including physical, financial, and historical data. For example, managers can view procurement records, usage status, and depreciation details of an asset on one interface, gaining a complete understanding of its overall status.

(4)Seamless Audit Verification

Asset management systems store the entire lifecycle data of assets, supporting cross-system historical data queries. In cases of asset transfers or disposals, auditors can easily retrieve complete records to expedite the audit process. For instance, the system can generate detailed reports on asset changes, including timestamps, personnel involved, and the scope of impact, making it easier for auditors to verify.

Technological Means to Break Information Silos in Asset Management Systems

The functionality of asset management systems relies on various technologies, including data integration platforms, data warehouses, and API interfaces. Commonly used technologies include:

(1)Data Integration Platforms

Data integration platforms consolidate, process, and distribute data from asset and financial systems, ensuring data consistency and visualization. Through ETL (Extract, Transform, Load) tools, enterprises can integrate disparate data sources and eliminate data silos.

(2)Data Warehouses and Data Lakes

Asset management systems can use data warehouses to manage structured data and leverage data lakes to handle unstructured data, providing a unified data view and enabling flexible data analysis. These tools are essential for leveraging asset management systems to break information silos.

(3)APIs and Microservices Architecture

APIs and microservices architecture facilitate data interaction between asset and financial systems, enabling flexible data sharing and integration. For example, asset management systems can use APIs to push real-time asset updates to financial systems.

The Value of Leveraging Asset Management Systems to Break Information Silos

In the process of digital transformation, information silos are a critical challenge for enterprises to address. By leveraging asset management systems to break information silos, enterprises can achieve synchronized asset data, efficient management, and intelligent applications. This not only enhances asset management efficiency but also lays a solid foundation for digital upgrades. Choosing the right asset management system will be a key step for enterprises to tackle the challenges of information silos. [ Learn More: The Features and Value of Asset Management Systems ]

Leveraging asset management systems to break information silos helps enterprises achieve consistency between accounting and actual data, automated depreciation calculation, comprehensive data querying, and seamless audit verification. This not only resolves pain points in traditional asset management but also establishes a strong foundation for digital transformation and intelligent management. In the future, as technology continues to advance, leveraging asset management systems to break information silos will play a role in more areas, helping enterprises stand out in the competitive landscape.

Learn more about the features of asset management systems. If you would like to explore how to choose the right asset management system for your business, contact us now to receive professional advice.