When purchasing equipment, do you only look at the quote? Many companies have fallen into the trap of thinki

ng “lower price equals better deal”—saving a few thousand initially, only to see costs double later due to maintenance, energy consumption, and downtime.

In reality, the key to determining if an asset is truly economical lies in its Life Cycle Cost (LCC). This cost accounting method helps you visualize the total real expenditure of an asset from procurement to disposal, preventing long-term losses caused by short-term decisions. Today, we break down the core logic of Life Cycle Cost and show you how to use it for smarter asset decisions.

1. What is Life Cycle Cost? A Simple Explanation

Simply put, Life Cycle Cost (LCC) is the total expense of an asset “from cradle to grave.” It includes not only the visible explicit costs (like the purchase price) but also the easily overlooked implicit costs (like repairs and energy consumption). The core goal is to answer one question: “From buying this to throwing it away, how much will it actually cost?”

Many people know they should calculate “total spending,” but they don’t realize the professional term for this concept is Life Cycle Cost (LCC). It is the core tool for enterprises to optimize asset allocation and control Total Cost of Ownership (TCO).

Unlike traditional accounting that focuses solely on the purchase price, LCC covers the asset’s entire life cycle:

- Concept planning and Procurement

- Operations and Usage

- Maintenance and Repair

- Disposal and Decommissioning

In some scenarios, the asset’s residual value (resale or recycling revenue) is deducted to make the cost calculation more precise. Whether for industrial equipment, engineering construction, or fixed asset management, LCC provides a more comprehensive basis for decision-making.

2. Core Components of Life Cycle Cost: Breaking Down the 4 Stages

To accurately calculate LCC, we need to break down the four core stages it covers. Among them, implicit costs are often the key factors influencing total spending.

| Life Cycle Stage | Core Cost Components | Cost Characteristics |

| 1. Acquisition Phase | Purchase price, installation & commissioning, site modification, training, acceptance testing | Explicit Costs. Usually accounts for 20%-30%. Most easily over-focused on. |

| 2. Operation Phase | Energy consumption, consumables, operator labor, raw material loss | Accounts for the highest percentage (over 50%). Directly affected by equipment performance. |

| 3. Maintenance Phase | Maintenance labor, spare parts replacement, breakdown repairs, tools & supplies | Concentration of Implicit Costs. Maintenance strategy directly affects cost levels. |

| 4. Disposal Phase | Dismantling, transport, environmental processing fees (minus residual value) | Accounts for the lowest percentage, but improper disposal can lead to compliance fines. |

According to a joint report by the U.S. Department of Energy and the Hydraulic Institute, for typical industrial equipment, acquisition costs often account for only about 10% of the Life Cycle Cost, while the remaining 90% comes from energy consumption and maintenance. This means if you only look at the purchase price, you are ignoring the largest part of the iceberg beneath the surface.

3. How to Calculate Life Cycle Cost? A Simplified Formula

Professional Life Cycle Cost accounting involves complex financial indicators like discount rates, but for daily corporate decision-making, mastering a simplified formula is enough for a quick estimate:

Life Cycle Cost = Acquisition Cost + Operation Cost + Maintenance Cost + Disposal Cost − Residual Value

Let’s break down each variable in plain language:

- Acquisition Cost: Total spending to buy and install.

- Operation Cost: Money spent while using the equipment (electricity, water, labor).

- Maintenance Cost: Money spent on repairs and upkeep (including spare parts).

- Disposal Cost: Money spent when throwing it away.

- Residual Value: Money recovered from selling scrap or resale after decommissioning.

For industrial enterprises, leveraging EAM/FM (Enterprise Asset Management / Facility Management) systems allows for more precise LCC calculations. These systems automatically record data on energy consumption, failures, maintenance, and downtime—especially implicit costs—avoiding omissions common in manual calculations.

4. Practical Application of LCC and Common Pitfalls

The value of Life Cycle Cost lies in its practical application. Let’s look at a real-world case to see how it helps you escape the “low price trap.”

4.1 Practical Application: Equipment Procurement Case Study

Suppose you need to purchase a production machine tool, and you currently have two options:

- Machine A (Budget Version): Purchase price $500,000. High energy consumption, fragile parts, average annual downtime of 5 days.

- Machine B (Premium Version): Purchase price $800,000. Low energy consumption, low failure rate, average annual downtime of only 1 day.

We calculate based on a 5-year usage period with a residual value of $50,000 for both:

| Cost Item | Machine A (Budget) | Machine B (Premium) | Notes |

| Purchase Price | $500k | $800k | A is $300k cheaper |

| Annual Ops (Power) | $150k | $80k | A costs $70k more/year |

| Annual Maint | $80k | $20k | A costs $60k more/year |

| Annual Downtime Loss | $100k | $20k | A has more failures & losses |

| 5-Year Total LCC | $2.0 Million | $1.35 Million | B saves $650k total! |

Conclusion: Looking only at the purchase price, A seems like a better deal; but when accounting for the 5-year Life Cycle Cost, buying the “expensive” Machine B actually saves the company $650,000. This is the decision-making power of LCC.

4.2 Common Pitfalls: Guide to Avoiding Mistakes

When applying Life Cycle Cost, avoid these three common mistakes to ensure effective decision-making:

- Counting only explicit costs, ignoring implicit ones: Implicit costs like production stoppages, defective goods, and safety accidents are often the “bulk” of LCC and need to be accurately recorded via asset management systems.

- Separating LCC from Revenue: Lower LCC isn’t always better; it must be evaluated alongside Return on Investment (ROI). For example, equipment with high LCC but extreme efficiency might generate higher profits.

- Keeping parameters static: Energy costs and spare parts prices fluctuate with the market. LCC calculations need to be dynamically adjusted.

5. How to Save on Life Cycle Cost?

Once you master the accounting logic, the key is to use scientific methods to reduce total cycle spending. Why must modern enterprises introduce professional management software? Professional EAM/FM software (such as SAMEX EAM or 313fm) is not just for recording asset lists; they are core tools for controlling LCC, achieving cost reduction and efficiency improvement through three main dimensions:

5.1 Refined Maintenance to Extend Equipment Lifespan

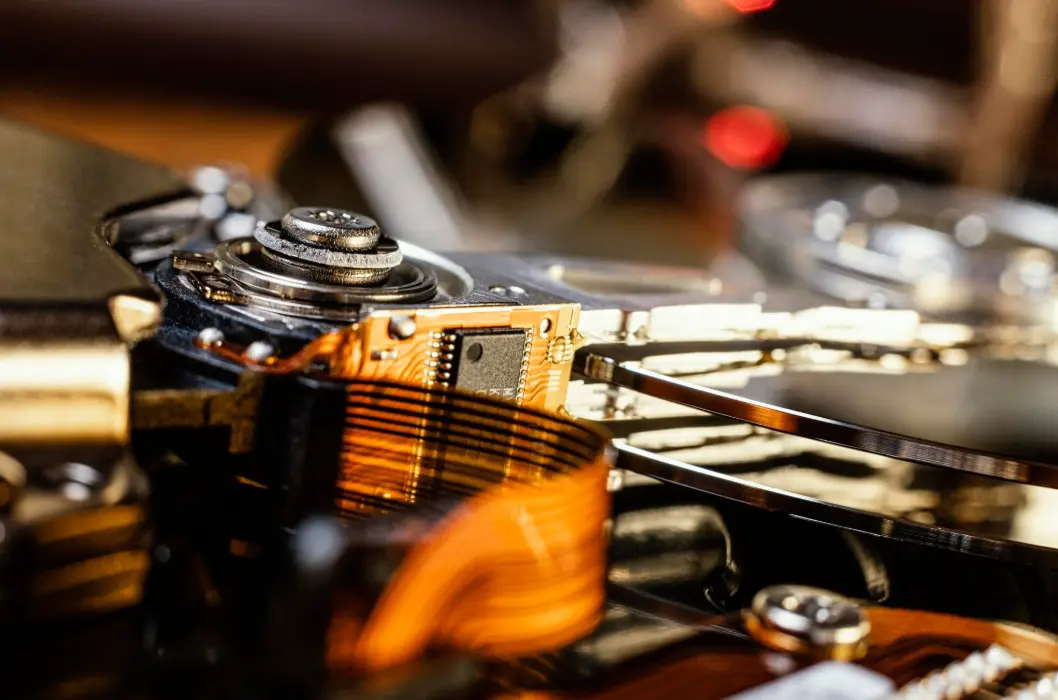

Equipment is like a car; it lasts longer when well-maintained. The traditional “fix it when it breaks” model accelerates aging, forcing companies to frequently pay expensive “acquisition costs” for new equipment.

EAM software can establish a full-process preventive maintenance system, automatically generating maintenance plans to ensure every piece of equipment runs in optimal condition. Through scientific maintenance strategies, companies can significantly extend asset service life, fundamentally postponing the massive capital expenditure of the next procurement round and lowering the average annual LCC.

5.2 Reducing Unplanned Downtime to Avoid Massive Losses

In the composition of LCC, production losses caused by unplanned downtime are often the biggest invisible killer.

According to the “True Cost of Downtime 2022” report by Siemens, global industrial giants lose up to $1.5 trillion annually due to unplanned downtime, shockingly accounting for 11% of annual revenue. This means for high-capacity factories, the profit loss from just a few hours of downtime often far exceeds the price difference of the equipment itself.

To plug this huge profit leak, manual inspection is no longer enough. Professional management software, through “preventive maintenance” and “condition monitoring,” can issue warnings before failures occur. Transforming “emergency repair” into “planned maintenance” not only avoids the huge losses and breach-of-contract risks caused by production line stoppages but also significantly reduces the premium costs of emergency spare parts procurement.

5.3 Optimizing Resource Allocation to Compress Hidden Costs

Beyond the equipment itself, spare parts inventory, labor efficiency, and management decisions are important components of LCC. Software helps companies precisely control resources through data transparency:

- Inventory Precision: The system sets safety stock levels based on historical consumption data, avoiding capital tie-up caused by overstocking (hidden cost) while preventing downtime caused by parts shortages.

- Labor Efficiency: Through digital dispatching, managers can reasonably allocate technician hours, reducing ineffective patrol travel and waiting times, thus increasing per capita maintenance output.

- Real-time Decision Making: Software captures equipment operating status in real-time, allowing managers to make decisions based on data rather than experience. For example, identifying abnormal equipment by analyzing energy consumption data and adjusting operating parameters in time to save long-term energy expenses.

Whether for large enterprises requiring deep asset management or SMEs pursuing agile maintenance, suitable digital tools can implement the above strategies. Although their application scenarios differ, the core goal is consistent: optimizing resource allocation through data to help enterprises excavate the maximum cost-saving space throughout the entire life cycle.

6. Making Long-Term Decisions with LCC + EAM/FM Software

The core value of Life Cycle Cost lies in breaking “short-term investment thinking” and letting enterprises see the true economic value of assets. Professional EAM/FM management software provides the practical tools for LCC optimization.

Whether for equipment procurement, project initiation, or fixed asset optimization, combining the two provides a full-dimensional cost control perspective, helping enterprises improve their Return on Investment (ROI).